Negative equity car finance

Need to change your current car but can't afford to settle your current finance deal? Negative equity finance is one potential solution.

Negative equity describes the situation when the current value of your car is less than the amount needed to pay off the finance on it. Go for a PCP finance deal and you're usually in negative equity for most of the contract, as cars typically depreciate faster than you're paying off the balance.

In fact, it's only at the end of the contract when the total amount you've paid to date - your deposit plus all the monthly payments so far - typically catch up.

For example, if you were a year into a PCP finance contract and your car had a current value of £10,000 and the early settlement figure on the finance - the amount needed to pay off the finance and own the car - was £12,000, the negative equity value would be £2000. That's because, even if you handed the car back early, you'd still owe an additional £2000.

Negative equity finance is typically used if your car finance payments become unaffordable and you need to get a cheaper car, or when your situation changes and you suddenly need to hand back the car as it has become unsuitable. That could be the case if, for instance, you unexpectedly had triplets and as a result needed a new car with space to fit three child seats.

Negative equity finance can also be used if you're struggling to pay charges for damage beyond fair wear and tear or excess mileage - racked up by going beyond the pre-agreed mileage limit - at the end of a finance agreement.

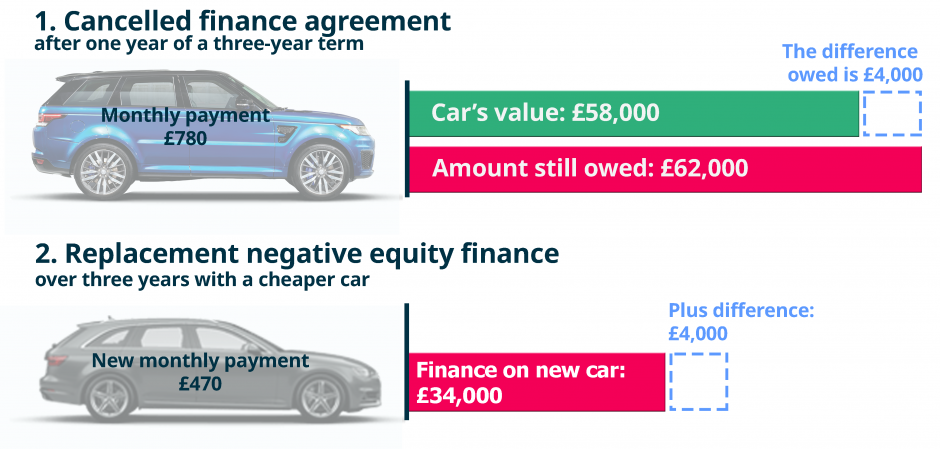

If you need to use negative equity finance, the outstanding debt from the original finance contract is rolled into a new finance agreement on another car, giving you one monthly payment for both the new car and the remaining balance or additional fees from your previous car.

What is negative equity finance?

Negative equity finance allows you to pay for a new car, and to repay additional costs from a previous finance agreement, all in one monthly payment. This can be used to reduce your monthly payments - provided you choose a cheap enough new car - or to upgrade early to another car.

If you're looking to reduce your costs, then the process will typically work as follows:

1. Pick another less expensive model - new or used

2. Take out finance on the new car with lower monthly payment and trade in your other vehicle

3. You'll be charged an extra amount each month to cover the negative equity

As long as your new car is substantially cheaper than your previous one, then you should pay less overall than if you had continued with the initial contract. It’s important to keep on top of your new monthly payments to avoid debts spiralling out of control, however.

Negative equity finance is not the only answer if you're struggling to make finance payments, so it's worth talking to your lender about other ways they can help. You can see some alternative options below.

If you're using negative equity finance to purchase a car that better suits your needs, then you may end up paying more than before. For example, if your city car is too small for you, then it may make sense to get a more expensive larger vehicle that could leave you with a higher monthly payment - especially when you factor in the extra amount you have to pay every month to cover negative equity on the first car.

Negative equity loans with PCP finance

Most negative equity finance is used to help pay the early settlement fees on PCP agreements, which offer low monthly payments and a range of options at the end of the contract, including returning or buying the car by making the large optional final payment.

Once you've found a replacement new or used car, you need to arrange negative equity finance. You'll then have your current car collected.

Your outstanding finance will be settled by the new finance provider and you'll then make one monthly payment to the new lender, which covers the finance for your new car, as well as any outstanding balance and/or fees owed from your previous contract.

Negative equity finance may also help at the end of PCP contracts, where you have the option of returning the car. If you have exceeded the mileage limit or damaged the vehicle, then you'll incur penalties. If these prove unaffordable, then you can use negative equity finance to pay these fees and to get another vehicle.

Negative equity loans with Hire Purchase

Negative equity is less of a problem for cars on Hire Purchase finance because the monthly payments are higher, which means that you pay off the balance quicker - and automatically own the car once you've made the last monthly payment. The remaining debt is less likely to exceed the car's value.

Hire Purchase is set up for customers who want to own the car at the end of the contract, so those with a HP arrangement are less likely to hand the car back in the first place.

However, if you do find yourself in negative equity early on in the contract and need to cancel your Hire Purchase contract, then you should be able to take out finance on a cheaper car, as part of a plan that will also allow you to spread the cost of the remaining balance and any fees on your previous vehicle.

Negative equity loans with car leasing

Terminating a car lease early can be expensive and more difficult than ending a PCP or HP contract, as you have fewer consumer rights. This means that whether you are able to end the contract early - and how much you have to pay to do so - are often down to the leasing company's discretion.

The cheapest option can sometimes be to continue with the lease - as you're normally committed to making all of the payments, even if you hand the car back - so it's even more important to check that negative equity finance is the right choice for you.

Where it does make sense to cover the early termination fees with negative equity finance, it is possible to get a new car on PCP or Hire Purchase.

As with PCP, you can face excess mileage and damage charges at the end of a lease. These can be covered by taking out negative equity finance on your next car. If you think you may need to end a contract early, however, it's best to avoid leasing, as PCP and Hire Purchase can offer you more flexibility, should your circumstances change.

Alternatives to negative equity finance

If you are struggling with your monthly payments negative equity finance isn't your only option. First off it's always best to speak to your lender and explain the situation, they may be able to help. There are also alternative options that are worth considering.

Refinancing

You may find that you can reduce your monthly payments by refinancing at a lower interest rate, or over a longer term. But you do need to take all charges into account: settlement fees are often incurred when you refinance.

Voluntary Termination

If you’ve already paid more than half of the total amount payable with PCP or Hire Purchase - this means the total of the deposit, all the monthly payments, the optional final payment (with PCP) and any other compulsory charges - then you can voluntarily terminate the finance agreement by handing the car back.

This right is set out in law and you should have nothing further to pay if you do this, but it will mean that you end up with nothing to show for your payments, even if you had been paying off Hire Purchase finance, which would have resulted in you owning the car once you'd made all the payments.

Some financial experts also warn that lenders may make a note when drivers use Voluntary Termination. While the law lets you use Voluntary Termination to avoid financial hardship, should you cut agreements short repeatedly, then it could mean some lenders refuse to approve you or offer you higher interest rates in the future. That's because using Voluntary Termination typically causes additional costs for the finance company.

Agreement with lender

If you're in financial difficulties, then lenders will sometimes offer a new payment plan that's more affordable to ensure that you are able to meet payments rather than falling behind. You'll need to talk to your lender about your particular circumstances to see what help may be available. This could involve spreading costs over a longer period to reduce your monthly payments or moving to a different type of finance.